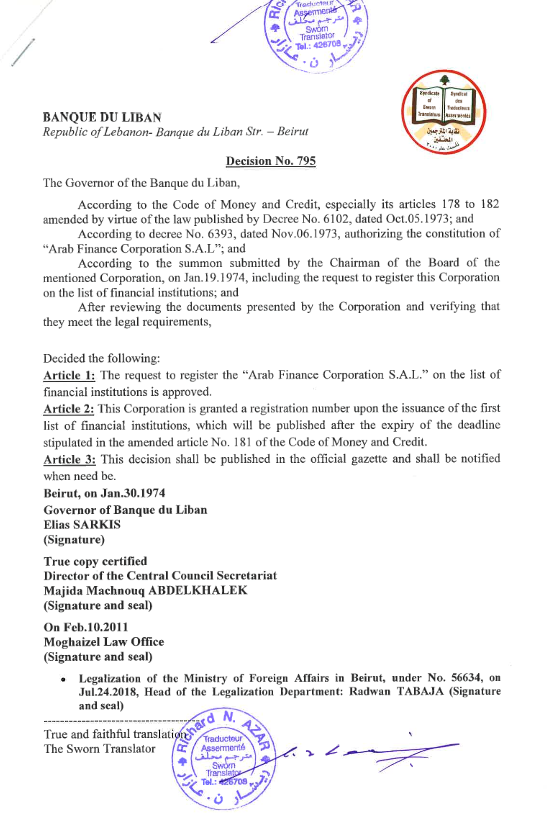

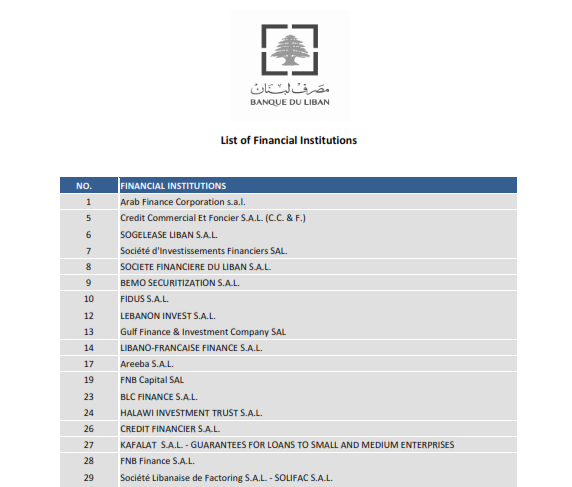

Established in 1974, Arab Finance Corporation is the first financial company to be formed in Lebanon. We hold the number one on Banque du Liban’s list of financial institutions. For half a century now, we have been offering a wide range of financial services to private and institutional clients in Lebanon, the region and worldwide. Over this period, we have seen quite a few financial institutions come and go as a result of financial, political, security or even family-related events. Early on, the founders of AFC understood that, as a client, you put great value in the experience and sustainability of the company you choose to trade with.

Whether it is trading solutions or internal equipment and systems, AFC offers various trading technology solutions to its clients. Our new position’s state-of-the-art trading desk is equipped with the latest technology in telecommunication systems and enables us to provide fast and efficient market access to the client. With regards to trading solutions, AFC is quite simply the first and only Lebanese institution to offer truly proprietary online trading technology to its clients.

In 2008, we launched the AFC BeirutTrader™ providing investors an online solution to trade on Beirut Stock Exchange.

We also offer the AFC Trader™ using the MT5 multi-award-winning platform with access to CFDs on Forex, Metals, Energies, Stocks, Indices, and ETFs.

Arab Finance Corporation offers 24-hour access to a very wide range of financial markets covering all geographical areas on multiple asset classes, such as equities, fixed-income, foreign exchange and commodities, whether on a full cash or derivatives basis, online or by phone. In this respect, one of the advantages enjoyed by AFC’s clients is the capacity to trade a variety of financial instruments on numerous asset classes via a single account. Clients also benefit from competitive and flexible commission structures. We also offer active advisory and discretionary management mandates which specifically target your investor profile and will help you reach your investment goals. On the investment banking side, our advisory professionals have been working with private corporate clients and financial institutions to analyze and implement strategic alternatives covering capital raising, direct investments and project promotion.

Arab Finance Corporation is a financial company regulated by Banque du Liban, and specifically controlled and supervised by the Banking Control Commission and the Capital Market Authority. As such, we are required to meet strict financial standards, including capital adequacy requirements, and to submit regular and detailed financial reports to our regulator. Banque du Liban, a legal public entity enjoying financial and administrative autonomy, grants licenses for the establishment of banks, financial institutions, brokerage firms, money dealers, foreign banks, leasing companies and mutual funds in Lebanon. The strict monitoring by Banque du Liban has worked to ensure transparency in the Lebanese financial sector and contributed to promoting public and private sector trust in the Lebanese financial system.