Understanding Financial Market Trends: How to Read and React

Introduction

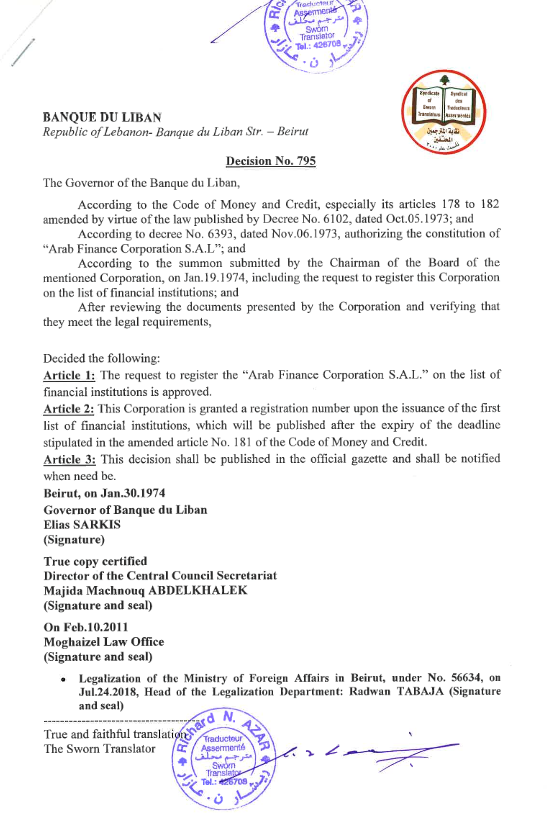

In the dynamic reality of financial markets, discerning and responding effectively to market trends is crucial for traders aiming for profitability and sustainability. Since 1974, Arab Finance Corporation (AFC) has excelled in equipping traders with the skills needed to navigate the complexities of global markets, with Emile Mehanna currently leading the way for two years now. If you are wondering how to understand the global market trends and adapt your strategy, the following blog is for you.

What Are Market Trends?

According to Morgan Stanley’s 2025 Investment Outlook, the financial landscape is anticipated to be influenced by diversified market strategies, emphasizing the need for investors to stay agile. This reflects an environment where market conditions and investor strategies are continuously evolving due to varying economic signals and policy changes globally.

Understanding market trends begins with recognizing the directional movement of markets or assets over different time frames. These trends can be categorized into three types: short-term, mid-term, and long-term, each serving distinct trading strategies and objectives:

- Short-term trends may last a few days to weeks

- Mid-term trends can span several weeks to months

- Long-term trends may persist from several months to years.

Recognizing these patterns is essential as they help traders anticipate potential market movements and strategize their investments accordingly.

In today’s interconnected economy, global events can have a profound impact on market trends. Economic announcements, geopolitical developments, and regulatory changes in one part of the world can influence market movements globally. For example, traders must monitor developments such as interest rate changes by major central banks, trade agreements, or international conflicts, as these factors can alter market dynamics dramatically. Adapting to these global trends requires a vigilant approach and a deep understanding of international market behaviors.

In addition to traditional economic factors, advancements in AI are becoming increasingly influential. BlackRock’s analysis highlights the significant role of artificial intelligence (AI) in transforming economic structures, suggesting that AI continues to drive market dynamics significantly. This transformation is creating new investment opportunities, particularly in the U.S. equities, as the AI theme broadens. They note that the market’s sensitivity to short-term news has increased, impacting long-term assets and contributing to heightened volatility.

How to Analyze the Data?

Analytical tools are essential for understanding market trends clearly and making informed decisions. Let’s break down a few of these tools to see how they help in everyday trading:

Technical Indicators: These are like the gauges and meters in a car—they provide different readings that tell us what’s happening under the hood of the market. For example:

- Moving Averages (MA): This tool helps smooth out price data by creating a constantly updated average price. The Simple Moving Average (SMA) is a straightforward type of moving average that simply takes the arithmetic mean of a given set of prices over the specific number of days in question, such as over the last 15, 30, 90, or 200 days. This helps traders see the overall direction the market is moving, upwards or downwards, without getting distracted by short-term fluctuations.

- MACD (Moving Average Convergence Divergence): This is a bit more sophisticated. It shows two moving averages converging (coming together) or diverging (moving apart). If they are moving apart, the market might be getting stronger; if they are coming together, the market might be weakening.

Trend Lines: Think of these as the lines you might draw on a graph to mark the upward or downward trajectory of a ball thrown in the air. In trading, these lines help us understand where the price of an asset might go based on its past movements.

Support and Resistance Levels: These are like invisible floors and ceilings that the price of an asset seems to bounce off of. “Support” is the price level at which a stock or market rarely falls below, while “Resistance” is the level it rarely exceeds. These levels can help traders decide when to buy or sell, based on the expectation that the price will bounce back from these points.

Understanding and using these tools allows traders to read market signals more effectively. They help point out when it might be a good time to enter or exit trades, reducing the guesswork and increasing the chances of making profitable moves. For instance, if a stock price moves above its 200-day moving average, a trader might take this as a sign that the stock is in a strong upward trend and consider buying.

By combining these tools, traders can form a clearer picture of market trends and act on them with greater confidence, minimizing risks and maximizing opportunities in financial planning.

“Recognizing a market trend is just the beginning,” Emile Mehanna points out. “The real skill lies in interpreting these trends within the broader market context, considering factors such as market volatility and economic indicators that could affect sustainability and strength of the observed trends.”

How to Apply Knowledge into Strategic Applications

Knowledge of market trends must be translated into actionable strategies. This involves not just following the trends but also anticipating potential shifts and preparing for them.

For instance, if a trader observes a strong bullish trend in the technology sector due to innovations or regulatory changes, they might increase their investments in high-performing companies within this sector. Conversely, awareness of a potential downturn could prompt strategies to hedge investments or reallocate assets to mitigate risks.

Emile Mehanna advises new traders, “Engage actively with the market data and trends, but do so with a disciplined approach. Use the trends you observe to inform your trading decisions and continuously refine your strategies based on real-world outcomes and learning.” This guidance is vital for new entrants in the trading world, emphasizing the importance of a calculated and informed approach to trading.

As a matter of fact, according to Deloitte, the financial services sector in 2025 will focus on agility, innovation, and customer-centric approaches to navigate complexities and meet new demands. This includes reinforcing foundations to adapt to a low-growth, lower-rate environment, particularly in banking and capital markets.

Mastering the art of understanding and reacting to market trends is a key differentiator between average and successful traders. It involves a blend of keen observation, rigorous analysis, and strategic execution. With insights from experienced professionals and the right analytical tools, traders can significantly enhance their ability to navigate through market uncertainties.

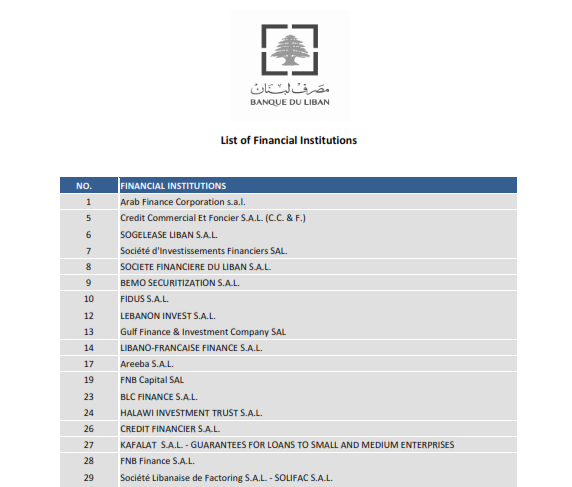

Discover How We Can Help You Grow Established in 1974, Arab Finance Corporation (AFC) is the first financial institution registered in Lebanon. We hold the number one on Banque du Liban’s list of financial institutions. For half a century now, we have been offering a wide range of financial services to private and institutional clients in Lebanon, the region, and worldwide. Our services range from financial markets, corporate finance advisory, asset management, to online trading services.