Steady Hands in Shaky Markets

In today’s unpredictable market landscape, it’s natural for investors to feel unsettled. Persistent inflation, uncertain interest rate policies, and escalating geopolitical tensions, including conflicts affecting global trade, energy markets, and supply chains, have all contributed to sharp market swings. At the same time, the global economic order itself is shifting. The rise of artificial intelligence and rapid technological innovation are further reshaping industries and investment strategies.

Yet, amid this complexity, investors who approach volatility with discipline, insight, and a clear, long-term strategy are best positioned to weather uncertainty and seize new opportunities. Understanding the root causes of current turbulence, particularly global trade tensions and the use of tariffs, provides essential context, helping investors remain grounded and prepared for the potential impacts on their portfolios.

As we go over how the market responds to such volatility, it becomes clear that the true challenge is not simply surviving market downturns, but understanding how to make calculated, well-informed decisions that serve long-term goals.

Understanding Market Volatility

Recent months have seen sharp fluctuations across global equity markets, driven by inflationary pressures, shifting monetary policies, and geopolitical tensions. Market volatility has resulted from a range of factors, most notably the escalating global trade war and the widespread imposition of tariffs. The uncertainty surrounding international trade has disrupted supply chains, shaken investor confidence, and contributed to unpredictable market behavior worldwide.

The impact has been felt far beyond larger economies; even smaller economies like Lebanon have been caught up, with the country facing a 10% tariff as part of President Trump’s sweeping trade measures. Such tariffs have added complexity to an already uncertain global market, influencing everything from commodity prices to consumer behavior.

Although such volatility may seem alarming, it is a recurring feature of financial markets, driven by political, economic, and psychological forces. Recognizing this cyclical nature is critical for investors aiming to maintain a disciplined approach through these turbulent times. The current environment emphasizes the importance of diversification, long-term planning, and making decisions based on solid financial fundamentals, rather than short-term noise or fear-driven decisions.

How to Handle Market Swings: The Power of Unbiased Advice

In times of heightened market turbulence, making sound investment decisions becomes increasingly complex. Professional guidance is not just helpful – it is essential. An advisor combines deep market experience with a proactive, personalized approach designed to help investors navigate uncertainty with clarity and confidence. Rather than reacting impulsively to daily market shifts, an advisor works alongside clients to develop tailored strategies that align with their long-term objectives.

An advisor’s role extends beyond portfolio management. They provide critical insights into how external forces, such as inflation, tariffs, political instability, and shifting monetary policies, can impact investments. This allows our clients to make informed decisions about risk, diversification, and portfolio adjustments when necessary. Their disciplined, research-driven approach is built to safeguard and grow wealth not just through market highs, but also through challenging periods when strategic thinking matters most.

“In volatile markets, emotion is the greatest risk. Our job is to replace fear with strategy and uncertainty with informed decision-making”, said Emile Mehanna, CEO, Arab Finance Corporation.

As a matter of fact, and according to a study by Brad Barber and Terrance Odean, individual investors who traded most actively underperformed the market by an average of 6.5% annually. This underperformance is largely attributed to emotional decision-making, such as overconfidence and panic selling during market downturns. These behaviors often lead investors to buy high and sell low, contrary to optimal investment strategies (CFA Institute Blog).

Opportunities Amid Volatility

Market “crashes” often present unique opportunities for seasoned investors. During periods of significant downturns, experienced investors may see such events as a “sale” on assets, offering the chance to acquire quality investments at a discount. The volatility that causes widespread panic can, in fact, create an environment ripe for strategic acquisitions. For example, during significant market declines, stocks of fundamentally strong companies may become undervalued, offering seasoned investors the opportunity to build wealth by purchasing quality assets at lower prices.

Moreover, seasoned investors understand that downturns are part of the cyclical nature of markets, and they tend to be less swayed by the emotional volatility that causes others to panic. By maintaining a clear strategy and a long-term focus, they are able to take advantage of opportunities that may be overlooked by more shortsighted market participants. This is where professional advisors, like AFC, come in. Their role is to help you recognize these opportunities and act on them strategically, without succumbing to the emotional pull of the market’s short-term fluctuations.

To reinforce the point about opportunities amid market volatility, Warren Buffett shared an insight: “A market downturn doesn’t bother us. It is an opportunity to increase our ownership of great companies with great management at good prices.”

Long-Term Investment Strategy Focus

Establishing a long-term investment strategy is crucial for navigating today’s financial markets. Such a strategy provides a structured approach to achieving financial goals, whether it’s wealth accumulation, retirement planning, or capital preservation. By focusing on long-term strategies, investors can better withstand short-term market fluctuations and avoid impulsive decisions driven by market volatility.

Research supports the benefits of long-term investing. According to Morgan Stanley, maintaining a long-term perspective can reduce the likelihood of losses and enhance the potential for returns through the power of compounding. Their analysis indicates that the probability of losing money in the MSCI World Index decreases significantly over longer investment horizons: 23% over one year, 11% over five years, and just 3% over ten years.

Focusing on Long-Term Goals

In light of current events, it is essential for investors to remain focused on their long-term goals. Short-term fluctuations, especially those driven by geopolitical factors like tariffs and trade wars, can be disorienting. However, staying committed to long-term objectives is the most effective way to weather periods of volatility. Over time, markets tend to rebound, and long-term investment strategies that focus on growth, diversification, and risk management are more likely to yield positive outcomes than those focused solely on short-term market movements.

Periodic reassessment of investment strategies with professional advice ensures that you remain prepared for whatever the market brings. At AFC, we emphasize the importance of staying disciplined, rebalancing your portfolio when needed, and adjusting strategies in response to changing market conditions without losing sight of the bigger picture. By focusing on your financial goals and maintaining a long-term perspective, you will be in the best position to manage through any period of market uncertainty.

Common Mistakes to Avoid During Market Turbulence

As investor Sanjay Bakshi pointed out back in 1996, market volatility often leads people to make poor decisions. One of the most common errors is attempting to time the market. Many investors believe they can predict market movements, buying when prices are low and selling when they are high.

However, this approach is rarely effective, as it is almost impossible to consistently anticipate short-term price changes. In fact, investors who attempt to time the market often find themselves entering or exiting positions at the wrong times, missing out on gains or locking in losses. Mistimed trades, missed opportunities, and higher transaction costs are the result of attempting to time the market based on short-term predictions rather than long-term fundamentals.

“Another frequent misstep is poor security selection. In times of uncertainty, investors may be tempted to chase trends or rely on unreliable tips, purchasing assets without fully understanding their fundamentals. Rather than chasing popularity or speculation, a more prudent approach involves assessing each investment as if buying the entire business”, explained Emile Mehanna, CEO of Arab Finance Corporation.

This means considering the company’s financial health, competitive position, and long-term prospects – factors that are much more reliable than temporary market noise. Making decisions based on rumors or hype often leads to disappointment, as those investments are not grounded in solid financial analysis.

Finally, emotional decisions can be the most damaging. Investors often become euphoric when markets rise and overly pessimistic when they fall, which leads to irrational decision-making. Holding on to losing positions in the hope of a rebound or selling off profitable assets too early out of fear both undermine long-term strategy. Developing emotional discipline and staying focused on a long-term approach is key to navigating volatile markets successfully. It is also essential to keep in mind that not every market downturn is an opportunity to sell off assets. Maintaining perspective during times of panic can prevent investors from making decisions that they may regret once the market stabilizes.

Conclusion

History has shown that markets consistently rebound from downturns, and volatility remains a normal part of the investment cycle. However, the time for these rebounds may vary. Some cycles might take years, and others several months or even weeks.

Partnering with experienced professionals like AFC offers a significant advantage, ensuring that investment decisions remain aligned with long-term objectives despite the short-term noise. Ultimately, long-term success in investing comes from staying informed, maintaining perspective, and having the confidence to remain committed through uncertainty.

Key aspects towards a healthy and sound financial plan are always centered around diversification, risk management, and proper asset allocation while always following the macro and micro aspects of the global markets.

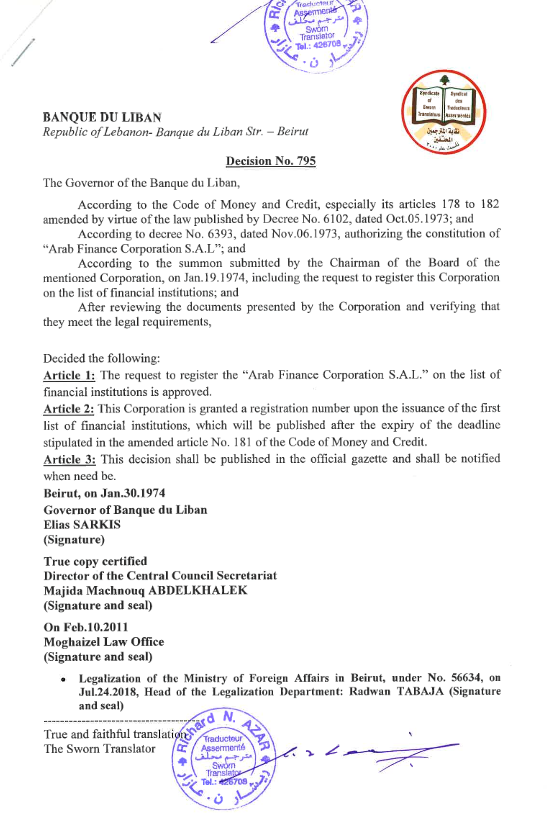

Discover How We Can Help You Grow

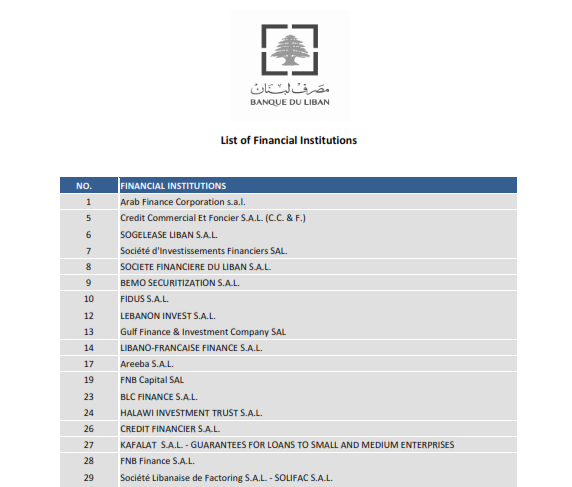

Established in 1974, Arab Finance Corporation (AFC) is the first financial institution registered in Lebanon. We hold the number one on Banque du Liban’s list of financial institutions. For half a century now, we have been offering a wide range of financial services to private and institutional clients in Lebanon, the region and worldwide. Our services range from financial markets, corporate finance advisory, asset management, to online trading services.

*This document contains information that is solely intended for the recipient to whom it is addressed, and is not intended to be used as investment research or a research recommendation. All of the data contained herein are indicative. This information, including any opinions, news, research, recommendations, and reports, are based on publicly available sources believed to be reliable, but its accuracy cannot be guaranteed and may be subject to change without notice. Arab Finance Corporation (AFC) does not guarantee the accuracy, timeliness, continued availability or completeness of such information. Neither the information provided, nor any opinions expressed, constitute a solicitation, offer, or personal recommendation. It is important to note that it does not constitute a comprehensive analysis of any specific financial instrument or investment strategy. Investors should independently decide whether a transaction is appropriate for them in light of their objectives, financial resources, investment knowledge, risk tolerance, and any other relevant considerations. AFC does not assume any liability for direct, indirect, incidental, or consequential damages resulting from any use of the information provided in this document. This publication is designed to provide general information about ideas and strategies. It is for discussion purposes only since the availability and effectiveness of any strategy is dependent upon your individual facts and circumstances.